|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

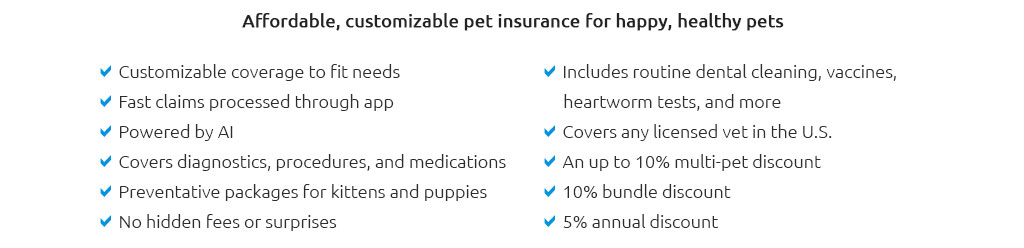

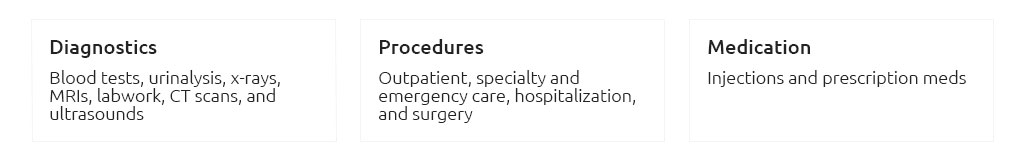

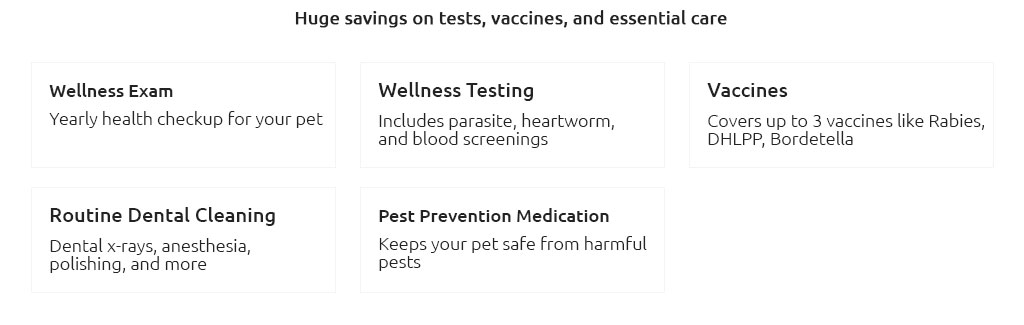

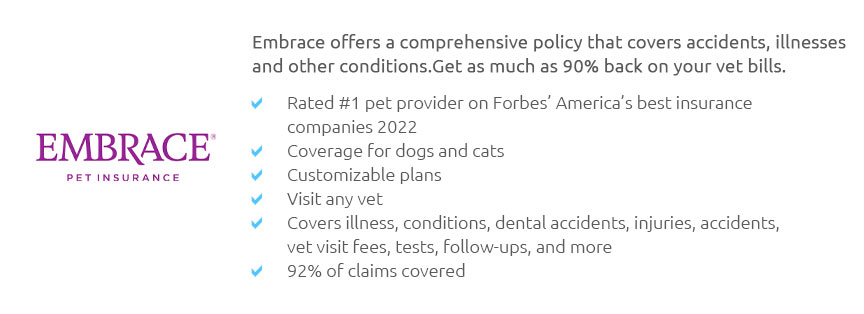

Compare Pet Insurance Plans for Cats: A Comprehensive GuideWhen considering the well-being of our feline companions, pet insurance emerges as a pivotal aspect of responsible pet ownership. Cats, with their curious nature and occasional health quirks, benefit immensely from having a safety net. However, the array of available insurance plans can be bewildering, demanding a keen eye and a discerning mind to navigate effectively. Firstly, it's important to understand the fundamental types of coverage. Accident-only plans are typically the most economical, offering protection for unforeseen injuries but excluding illnesses. Such plans might suit younger cats less prone to ailments but more likely to get into scrapes. On the other hand, comprehensive policies cover both accidents and illnesses, providing a more robust shield against veterinary expenses. They often include coverage for chronic conditions, which can be a lifesaver as your cat ages and requires more frequent medical attention. Another layer of complexity is added with the inclusion of wellness coverage. Some insurers offer add-ons for routine care, vaccinations, and preventive treatments. While these can increase monthly premiums, they also ensure regular vet visits, crucial for maintaining your pet's health. Thus, when comparing plans, it’s vital to weigh whether the peace of mind provided by such comprehensive coverage justifies the additional cost.

Ultimately, the choice of pet insurance should align with your financial situation and your cat’s specific needs. While some may view insurance as an unnecessary expense, others appreciate the security it provides against unexpected veterinary costs. Engaging in a thorough comparison of pet insurance plans is a prudent step toward ensuring that your feline friend receives the best possible care, come what may. In this ever-evolving market, staying informed and choosing wisely will not only benefit your beloved pet but also bring you peace of mind. https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

On a monthly basis, that's roughly $17 for a dog and $10 for a cat. However, an accident-only plan won't pay for conditions such as cancer, ... https://www.trupanion.com/pet-insurance/pet-insurance-comparison

The best cat insurance and dog insurance coverage stand out. Explore the difference one simple plan can make with unlimited payouts, VetDirect Pay, and so much ... https://www.petinsurancereview.com/pet-insurance/NY

We compare prices from pet insurance providers across the state that have proven track records for quality coverage and a willingness to stand by pet parents ...

|